401k minimum distribution chart

Regardless of match if you can make the maximum 401K contribution in a given year do it. The chart below shows how much 100 would be worth today if you invested approximately 10 years ago.

New Rmd Rules 2020 Ira Required Minimum Distributions Otosection

The Bipartisan Budget Act passed in January 2018 issued new rules that make it easier to withdraw a larger amount as a hardship withdrawal from a 401k or 403b plan.

. Who Its Best For. Like any other distribution from the Y 401k Plan the distribution of amounts attributable to the dollar equivalent of the unused paid time off is subject to an additional 10 income tax under 72t unless the distribution satisfies one of the exceptions described in 72t2 such as being made on or after the date on which the. LTC DOGE and other cryptocurrencies with 0 in fees and a minimum starting investment of just 1.

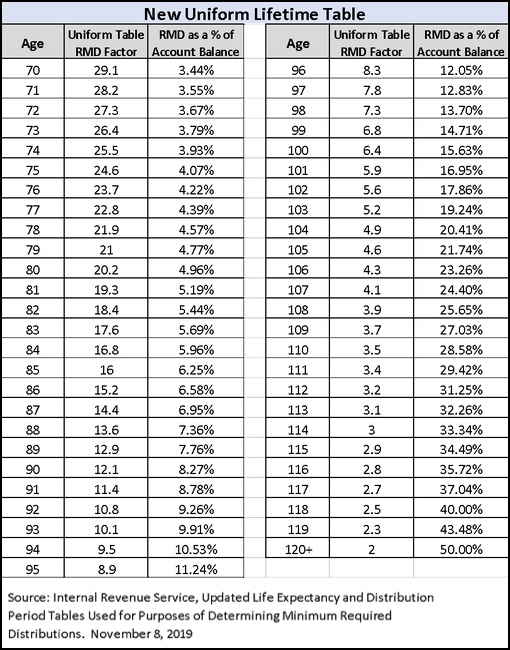

Gold IRA Rollover from 401K 403B 457B. While require minimum distributions RMDs from solo 401k plans. A factor of 274 at age 72 means that out of a 1 million total balance in the pre-tax retirement accounts as of December 31 of the previous year someone who reaches age 72 in the current year must withdraw a minimum of.

At a minimum you should be able to get unemployment insurance but you also should check out to see if they can offer. CAA also did not extend the solo 401k participant loan payment due date or increase the loan amount from 50000 to 100000. A 401k plan is a company-sponsored retirement account to which employees can contribute income while employers may match contributions.

Retirement Topics Required Minimum Distributions RMDs IRS. The factor for age 72 in the previous table was 256 which means the required minimum distribution wouldve been. It is also possible to roll over a 401k to an IRA or another employers plan.

A Gold IRA can be created from scratch by utilizing funds up to the annual maximum contribution of 5500 for investors under 50 years of age or 6500 for investors over the age of 50. At age 72 you must begin taking required minimum distributions RMDs from the plan. Repeat steps 1 through 3 for each of your IRAs.

One formula is based on your age another is like an annuity and I forget off the top of my head what the 3rd formula is. 401k Resource Guide - Plan Participants - General Distribution Rules Internal Revenue Service. Minimum distribution for this year from this IRA.

But the bottom line is you CAN tap 401k IRA money before 59 12 without. Unfortunately no CAA did not extend the solo 401k distribution deadline in account of COVID-19. Required minimum distribution RMD is the IRS-mandated minimum annual withdrawal amount from tax-deferred retirement accounts for participants aged 70 ½ or 72 depending on the year they were born.

To learn more about other Schwab Bank checking accounts please contact Schwab Bank at 888-403-9000. Note that each distribution must be at least the required minimum distribution RMD in order to avoid a penalty. While it may help you in the short term a 401k hardship withdrawal can throw a real wrench in your long-term retirement goals.

This type of stock pays out a distribution of cash or stock to its shareholders regularly so they are commonly used. Internal Revenue Service. At age 72 retirees are mandated to start taking required minimum distributions RMDs.

Table III Uniform Lifetime Age Distribution Period Age Distribution Period Age Distribution Period Age Distribution Period 70 171274 82 94 91 106 42 71 163265 83 95 86 107 39 72 155256 84 96 81 108 37 73 34247 85 148 97 7. Retirement Topics - Beneficiary Internal Revenue Service. Required Minimum Distribution Worksheets.

Get the latest financial news headlines and analysis from CBS MoneyWatch. RMD is calculated based on life expectancy and the account balance at the end of the previous year. There are two basic types of 401kstraditional and.

Additional Resources for 401k Required Minimum Distributions. The Schwab One brokerage account has no minimum balance requirements minimum balance charges minimum trade requirements and there is no requirement to fund this account when opened with a linked High Yield Investor Checking account. Theres a difference between how annual required minimum distributions RMDs are handled for a Roth 401k compared to a Roth IRA.

RMD Comparison Chart IRAs vs. Defined Contribution Plans IRS. A qualified distribution from a Roth IRA is tax-free and penalty-free.

No taxes will be imposed on rollovers. John must receive his 2020 required minimum distribution by December 31 2020 based on his 2020 year-end balance. Key Takeaways Withdrawals made from 401k plans are subject to income tax at your effective tax rate.

Of course always get free 401K matching dollars before contributing to an IRA. Publication 590-B Distributions from Individual Retirement Arrangements IRAs. Roth IRAs do not mandate RMDs during the lifetime of the account.

And you might even want to consider a new employer if youre not getting a pension. For these limits please see the following chart. In the United States a 401k plan is an employer-sponsored defined-contribution personal pension savings account as defined in subsection 401k of the US.

Previously the RMD was 70½ but following the Setting Every Community Up For Retirement Enhancement SECURE. Check it out on the IRS web site. The 2022 401K maximum contribution is 20500 6500 if over age 50.

Although the minimum to open a standard account is 3000 the company also offers a Saver IRA that requires an initial deposit of 100 with a recurring investment of 100 per month through a. Then do a substantially equal distribution from the IRA. A 401k hardship withdrawal reduces the amount of your retirement account permanently.

Like the traditional 401k the terms of Roth 401ks stipulate that required minimum distributions RMDs must begin by age 72 unlike Roth IRAs though this requirement was also waived for. Fist off when you retire roll the 401k to an IRA. The same reporting and distribution requirements apply to a Gold based IRA account as to a regular traditional.

Periodical employee contributions come directly out of their paychecks and may be matched by the employerThis legal option is what makes 401k plans attractive to employees and many. If John receives his initial required minimum distribution for 2019 on December 31 2019 then he will take the first RMD in 2019 and the second in 2020. Annuities held inside an IRA or 401k are subject to RMDs.

To be considered a qualified distribution the 5-year aging requirement has to be satisfied and you must be age 59 ½ or older or meet one of several exemptions disability qualified.

2

How Required Minimum Distributions Work Merriman

Ira Rmd Calculator Ira Owners 70 1 2 72 Secure Act And Older

:max_bytes(150000):strip_icc()/dotdash_Final_Probability_Distribution_Sep_2020-01-7aca39a5b71148608a0f45691b58184a.jpg)

Probability Distribution Definition

Where Are Those New Rmd Tables For 2022

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Back To The Basics Required Minimum Distributions Rmd Fourth Dimension Financial Group

72t Distributions The Ultimate Guide To Early Retirement

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Sjcomeup Com Rmd Distribution Table

Sjcomeup Com Rmd Distribution Table

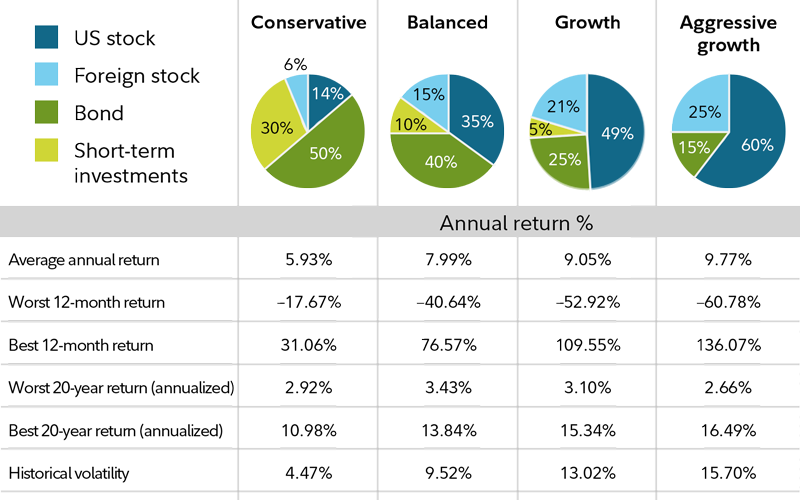

How To Invest Your Ira Fidelity

Sjcomeup Com Rmd Factor Table

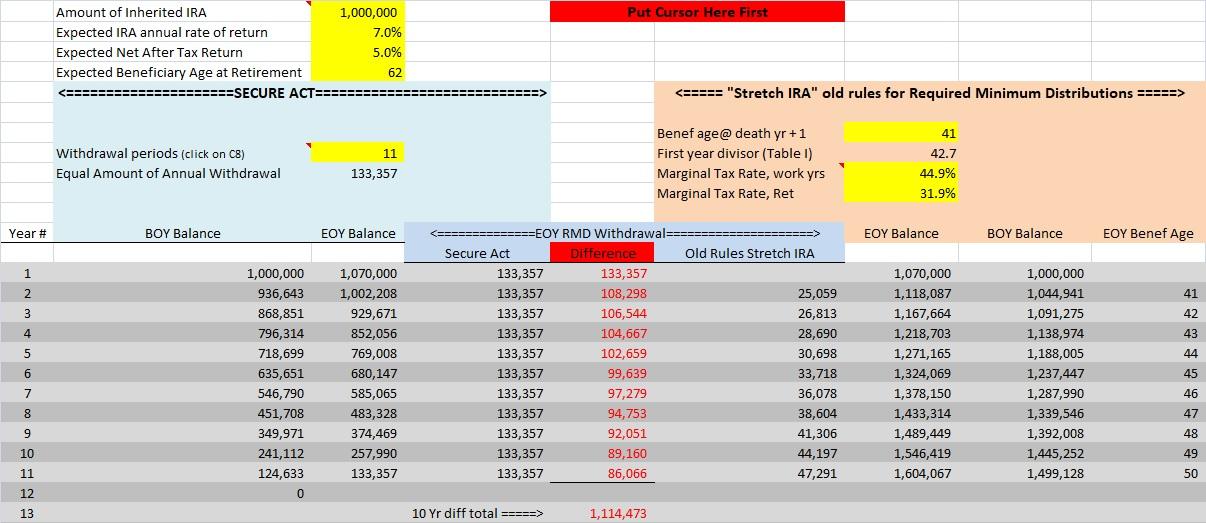

The Secure Act And The Demise Of The Stretch Ira Seeking Alpha

![]()

Required Minimum Distributions Ameriprise Financial

Where Are Those New Rmd Tables For 2022

How Much Should I Have Saved In My 401k By Age